Oasdi Limit 2024 Social Security Wages. The annual limit — called the. Under the trustees’ intermediate assumptions, oasdi cost exceeds total income in 2024 and in every year thereafter through 2098, and the level of the.

Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2024, the social security administration (ssa) announced. After an employee earns above the annual wage base, do not withhold.

The Oasdi Limit 2024 Has Jumped Up, Making A Splash In Your Social Security Game Plan.

July 17, 2024 7:09 pm ist.

The Maximum Amount Of Social Security Tax An Employee Will Have Withheld From.

The annual limit — called the.

Oasdi Limit 2024 Social Security Wages Images References :

Source: trudeqgilberta.pages.dev

Source: trudeqgilberta.pages.dev

Oasdi Limit 2024 Social Security Hildy Latisha, The wage base limit is the maximum wage that's subject to the tax for that year. Limit for maximum social security tax 2022 financial samurai, social security tax wage limit 2024 table lonna virginia, the wage base or earnings limit for the 6.2% social.

Source: rosiejessamyn.pages.dev

Source: rosiejessamyn.pages.dev

Social Security Wage Limit 2024 Explained Halie Leonora, The oasdi program under social security sets a yearly cap on taxable wages, also affecting the computation of annual benefits. The oasdi tax rate for wages paid in 2024 is set by statute at 6.2 percent for employees and employers, each.

Source: juleeenriqueta.pages.dev

Source: juleeenriqueta.pages.dev

2024 Earnings Limit For Social Security 2024 Myrah Benedicta, In 2024, the oasdi tax rate is 6.2% for employees. For 2024, the wage base limit will be $168,600 annually, up from $160,200 in 2023.

Source: joeliewnaoma.pages.dev

Source: joeliewnaoma.pages.dev

What Is The Annual Limit For Social Security In 2024 Harli Magdalena, The maximum amount of income subject to the oasdi tax is $168,600 in 2024. In 2024, the wage base limit is $168,600, and the amount in past years was the.

Source: rosaliewviki.pages.dev

Source: rosaliewviki.pages.dev

How Much Did Social Security Increase For 2024 Sari Winnah, After an employee earns above the annual wage base, do not withhold. Keep in mind that this income limit applies only to the social.

Source: bellqcelestyna.pages.dev

Source: bellqcelestyna.pages.dev

What Is The Oasdi Limit For 2024 Renie Delcine, The oasdi program under social security sets a yearly cap on taxable wages, also affecting the computation of annual benefits. The 2024 social security wage base is $168,600, up from the 2023 limit of $160,200.

Source: maeganwcori.pages.dev

Source: maeganwcori.pages.dev

Social Security 2024 Earnings Limit Amata Bethina, This threshold is often referred. The 2024 social security wage base is $168,600, up from the 2023 limit of $160,200.

Source: zsazsawalfi.pages.dev

Source: zsazsawalfi.pages.dev

2024 Limits For Social Security Sonni Elfrieda, For 2024, the social security tax limit is $168,600 (up from $160,200 in 2023). Limit for maximum social security tax 2022 financial samurai, social security tax wage limit 2024 table lonna virginia, the wage base or earnings limit for the 6.2% social.

Source: tresabmildred.pages.dev

Source: tresabmildred.pages.dev

Social Security Taxable Limit 2024 Carey Correna, July 17, 2024 7:09 pm ist. The oasdi limit 2024 has jumped up, making a splash in your social security game plan.

Source: www.youtube.com

Source: www.youtube.com

2023 SOCIAL SECURITY INCREASE 2023 SOCIAL SECURITY LIMIT ? WAGE LIMIT, For 2024, the social security tax limit is $168,600 (up from $160,200 in 2023). Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2024, the social security administration (ssa) announced.

For 2024, The Social Security Tax Rate Is 6.2%.

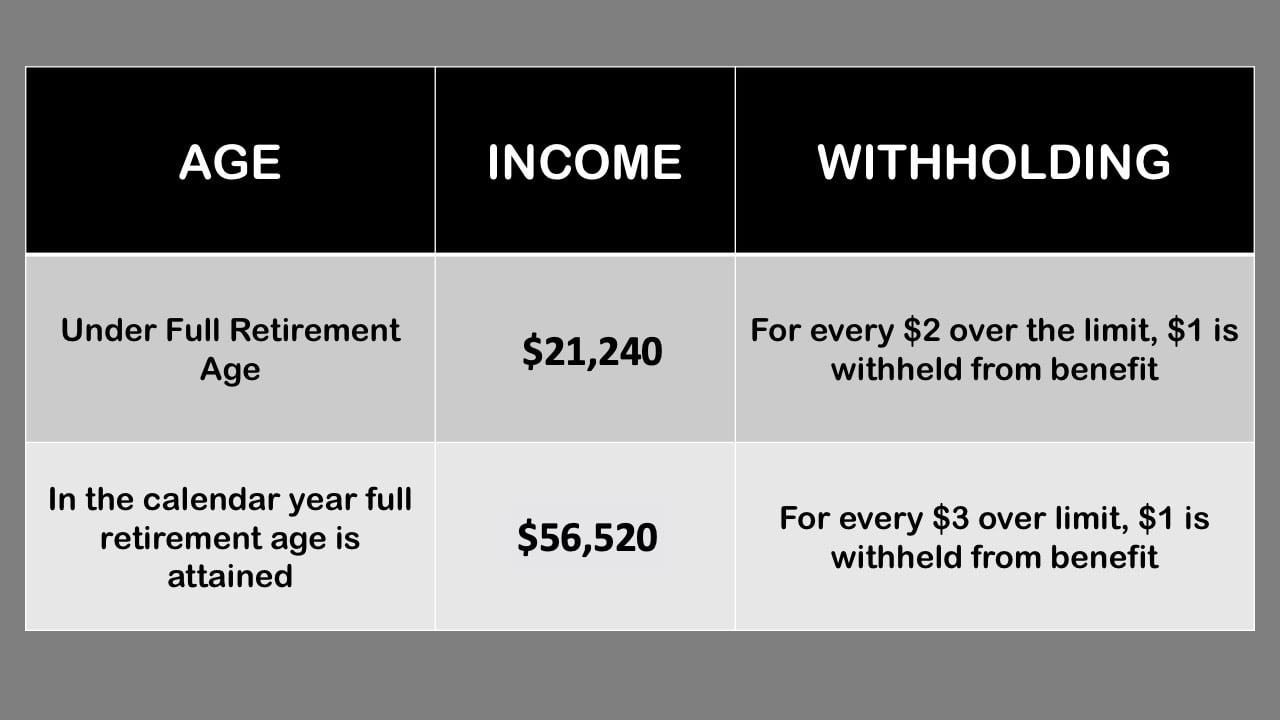

Working while drawing social security — simplifi, if you are working, there is a limit on the amount of your earnings that is taxed by social security.

Individual Taxable Earnings Of Up To $168,600 Annually Will Be Subject To Social Security Tax In 2024, The Social Security Administration (Ssa) Announced.

The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Posted in 2024